The 2026 Deloitte Football Money League reveals record growth and new challenges in club finances. The top 20 teams generated over €12 billion in 2024/25, up 11% year-on-year, reflecting both the strength and inequality of modern football.

This article highlights key insights for executives—covering revenue trends, commercial dominance, regulation, and the rise of women’s football—to guide mid-tier clubs in a rapidly shifting market.

By Joachim Stelmach

Record-Breaking Aggregates: €12.4 Billion and Counting

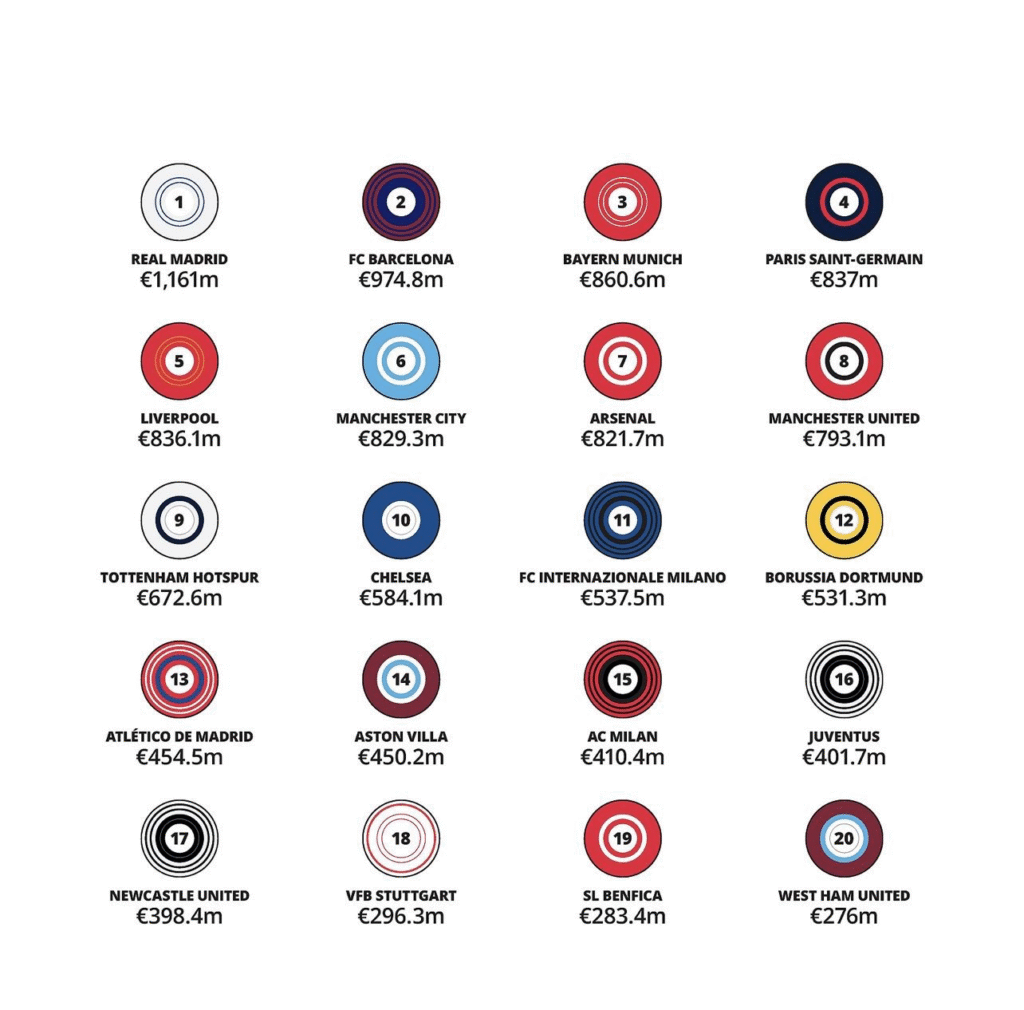

The headline figure from the 2026 Money League is the collective revenue of €12.4 billion generated by the top 20 clubs, up from €11.2 billion in 2023/24. This 11% growth reflects a post-pandemic rebound, driven by expanded competitions, global branding, and diversified income sources.

Matchday revenues reached €2.4 billion, broadcasting €4.7 billion, and commercial activities a record €5.3 billion—the first time any single stream exceeded €5 billion.

For business leaders, this signals a shift toward a materially higher financial plane. Clubs are no longer only sports entities but global entertainment brands. The top 10 clubs averaged €837 million in revenue, a 60% increase over the past decade, while ranks 11–20 saw an 84% rise to €404 million.

This narrowing gap shows mid-tier clubs catching up through smarter revenue levers, especially broadcasting deals tied to on-pitch success.

Key takeaway: sustainable growth requires balancing short-term wins with long-term investments. Premier League clubs, with nine entries in the top 20, have leveraged global broadcast rights. Yet the report warns of saturation, urging expansion into untapped markets such as Asia and North America.

Top of the Table: Real Madrid’s Dominance and Continental Resurgence

Real Madrid retained the top spot for the third consecutive year, becoming the only club to surpass €1 billion in revenue—reaching €1.161 billion, an 11% increase. Their commercial revenue (€594 million) alone would place them in the overall top 10, driven by sponsorships such as the €75 million annual HP sleeve deal and stadium modernization.

Barcelona followed with €974.8 million (+27%), Bayern Munich €860.6 million (+12%), Paris Saint-Germain €837 million (+4%), and Liverpool €836.1 million (+17%).

For the first time, the top four positions are held by continental European clubs, pushing Premier League giants like Manchester City (€829.3 million, -1%) and Arsenal (€821.7 million, +15%) lower. This new order reflects the revamped Champions League format, which increased match numbers and boosted both broadcast and matchday income.

PSG’s Champions League victory drove record shirt sales and sponsorship interest.

Business insight: on-pitch performance remains a critical revenue driver. Executives must align squad investments with UEFA’s Squad Cost Ratio (SCR), which caps spending at 85% of revenues.

Mid-tier clubs, often reliant on broadcasting, should follow Bayern’s balanced model, where 48% of top-10 revenues come from commercial sources—providing resilience against broadcast fluctuations.

Commercial Revenue: The Structural Differentiator

Commercial income’s rise to €5.3 billion cements its role as a structural differentiator. For top-10 clubs, it makes up 48% of total revenue. Real Madrid’s €594 million showcases how clubs blend merchandise, sponsorships, and brand extensions.

Sponsorships are shifting toward performance-based marketing, where fan engagement metrics define success. New regulations, like gambling ad bans in the Premier League, push clubs toward fintech and wellness partners, raising ROI by up to 25%.

For executives:

- Diversify beyond traditional sponsors.

- Invest in data analytics to personalize fan experiences.

- Turn fan data into measurable loyalty.

Clubs like Tottenham (€672.6 million, +9%) treat their stadiums as year-round assets, hosting events beyond football. Mid-tier clubs should add digital KPIs to sponsorship contracts for better leverage.

The Premier League’s Influence and Global Polarization

With 15 of the top 30 clubs, the Premier League leads with €7.4 billion in total revenue, though its top teams slipped in rankings. This polarization mirrors the wider industry: elite clubs pulling away while private equity demands profitability over growth.

Leagues with equal revenue sharing, such as the Bundesliga, show stronger mid-tier competitiveness. The lesson for business is clear: balanced investment models and AI-driven fan engagement can level the playing field.

Women’s Football: A Growth Engine with Untapped Potential

The women’s Money League shows top-15 clubs generating €158 million. Arsenal Women lead with €25.6 million (+43%), followed by Chelsea (€25.4 million) and Barcelona (€22 million).

Commercial revenues account for 72%, powered by trophies and data-based audience insights. Arsenal’s attendance of over 35,000 fans multiple times highlights commercial potential.

Implications: women’s football offers high ROI. Executives should integrate women’s teams into club strategies, sharing infrastructure and costs. The gap between the top three (average €24.3 million) and the rest (€7 million) reveals opportunities in branding and digital expansion.

Key Takeaways for Club Executives

- Prioritize commercial resilience: build models less dependent on broadcast cycles. Measure ROI through fan retention.

- Leverage on-pitch success strategically: align investments with SCR rules to avoid penalties.

- Embrace digital and AI innovation: invest in tech for performance marketing and sustainability.

- Address polarization: push for fairer revenue sharing. Focus on niche or regional markets to compete.

- Prepare for regulation shifts: diversify sponsorship portfolios early.

- Scale women’s programs: treat them as business growth drivers.

The Future of Football Business: Innovation and Equity

The 2026 Deloitte Football Money League portrays an industry thriving yet unequal. For executives, the message is to innovate responsibly—transforming clubs into tech-driven, fan-focused businesses.

As Real Madrid proves, dominance stems from heritage mixed with modern commercial strength. Yet, sustainable growth depends on equity, ensuring mid-tier clubs also thrive.

Examples like Brighton (€256.8 million, rank 21) show how smart strategy can deliver outsized success. By adopting these lessons, clubs can navigate the evolving football economy—where emotion meets economics.

***

If you’re seeking more on financial strategies or case studies, explore our FBIN Knowledge Hub for articles, interviews, and tools tailored to football business professionals.

Upgrade to Premium Now

Upgrade to Premium Now